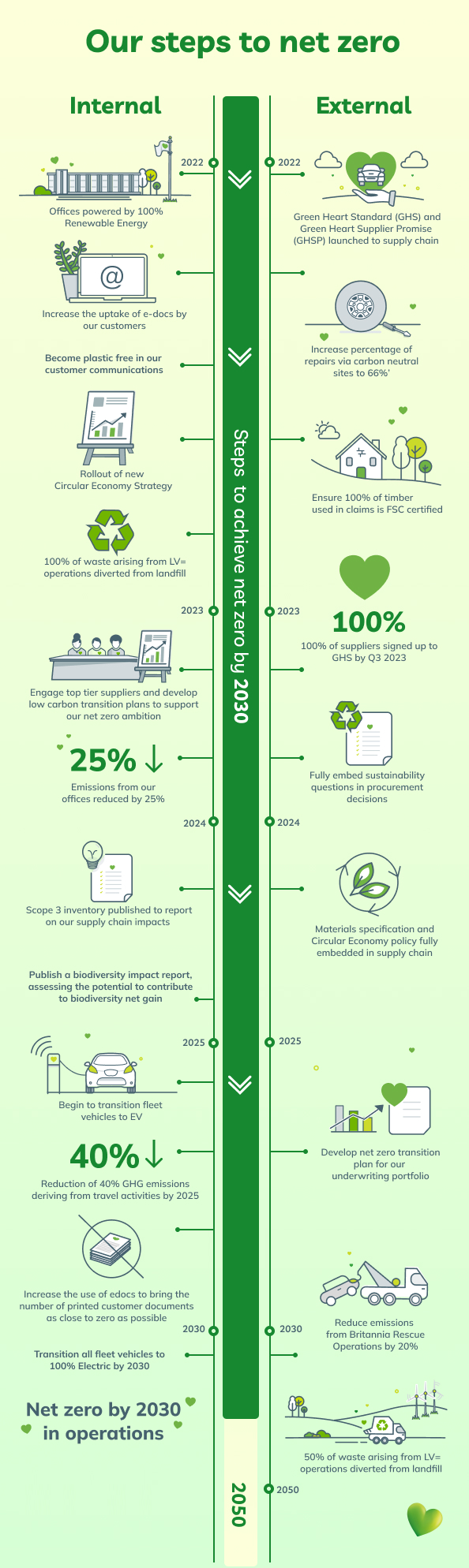

Influencing change means all of us taking meaningful steps together. Our commitment to sustainability matches our ambition to be the number one sustainable insurer in the UK. We are committed to net zero in our operations by 2030 and being net zero in our underwriting portfolio by 2050.

Our Partnership

We take a broad approach to sustainability by looking at all aspects of our business to make sure we continue providing excellent products and market-leading service to our business partners. By producing solutions and working to reduce the impact of our business on the environment, we provide our partners with a variety of GI products that reflect the changing nature of the insurance industry.

Our Goals

We strive to bring ESG (Environmental, Social & Governance factors) into all areas of our organisation. We create a diverse workplace where people and performance matter, where we reduce environmental impact, and where we support social inclusion. Through teamwork and partnerships our aim of becoming the most sustainable insurer is achievable. We can align our strategies and milestones to ensure we work in the most sustainable way to reduce our impact on the planet and environment .

The Short-Term Goals

As part of the Allianz Personal family, we’re committed to achieving these goals by 2025:

- Reducing the Green House Gas emissions of each employee by 30%;

- Powering our offices with 100% renewable power by 2023;

- Reducing the emissions associated with our offices by 20% per employee;

- Reducing business travel per employee by 15%;

- A 20% reduction in paper use per policy;

- A 10% reduction in water use per employee; and

- A 10% reduction in waste per employee.

- By working on these initiatives, we can ensure our environmental impact is reduced. We’ve already started taking steps to reduce our impact, and in April 2022 we strengthened our commitments to reducing our impact, by:

Our Operations:

- Net zero by 2030 in operations.

- Reduce GHG emissions by 70% versus 2019 by 2025 (was -50%).

- Sourcing 100% renewable electricity by 2023.

- Fully electric corporate car fleet by latest 2030.

- Reduction of 40% GHG emissions deriving from travel activities by 2025.

- To address its remaining emissions, Allianz will use high-quality removal solutions focusing on promoting high performance of carbon removal

Our Products & Propositions

Customer Propositions

We’re committed to becoming net zero in our operations by 2030 and transitioning our underwriting portfolios to net zero by 2050. To achieve this and respond to the challenges of climate change, we’re working hard to create sustainable insurance products with the aim of reducing our impact on the environment.

How can our products help support this aim?

LV= Home Insurance

We recognise customers are looking for ways to be more energy efficient. That’s why we protect solar panels and heat pumps against any damage covered by our buildings insurance.

LV= Motor Insurance

We offer a dedicated Electric Vehicle policy that includes features like recovery to the nearest charge-point if you run out of charge, cover for charging cables as standard and battery cover for accidental damage, fire and theft.

As part of our commitment to have a positive influence on society and be environmentally responsible, we’ve launched our Green Heart Standard for our body shop repair network (see Managing the Impact of Claims, below). This includes working with our body shops to become accredited as Carbon Neutral to the PAS2060 standard.

Paperless documents

We're able to offer our customers the ability to go paperless. This includes email communications and online ‘accounts’ where they can access their policy documents.

Managing the Impact of Claims

At LV= we’re committed to reducing the environmental impact of claims. We support our suppliers to adopt ethical practices and make sure the materials and products we buy have the lowest possible environmental impact.

We’re also exploring ways to promote a circular economy, including initiatives like repair over replace, up-cycling materials and making sure we recycle, repurpose or divert from landfill.

Working with our body shop partners, we’ve set a target that all our partner sites need to achieve carbon neutral status and receive a PAS 2060 certification. In addition, we offer our customers electric vehicles as courtesy cars to support their adoption. We also promote the use of green, safe, traceable, recycled parts as part of an environmentally aware repair service.

Our Suppliers

We’ll ask all global suppliers to have a public commitment to net-zero GHG emissions in line with 1.5°C path by 2025.

Our Partners

By reducing our environmental impact, we hope to influence our partners to further consider your environmental impact. So if you aren’t already, we’d like you to consider working towards a variety of commitments.

These include:

- Effectively reducing carbon emissions year on year, with an overall aim of net-zero operations.

- Setting science-based targets and implementing 100% renewable energy sources where possible.

- Considering and encouraging use of Social Enterprises within their own supply chains.

- Monitor and track all applicable Environmental, Social and Governance (ESG) risks and opportunities, making sure these are discussed at senior level for awareness and action.

- Working towards reducing any gender pay gap based on performance and merit.

We want this Sustainability Statement to showcase our commitment to supporting our customers and supply chain to reduce their environmental impact.

ESG is embedded in our core business processes to manage risks and capture opportunities.

We look forward to working with you in helping improve the sustainability of financial services.